World Energy Outlook, IEA 2023

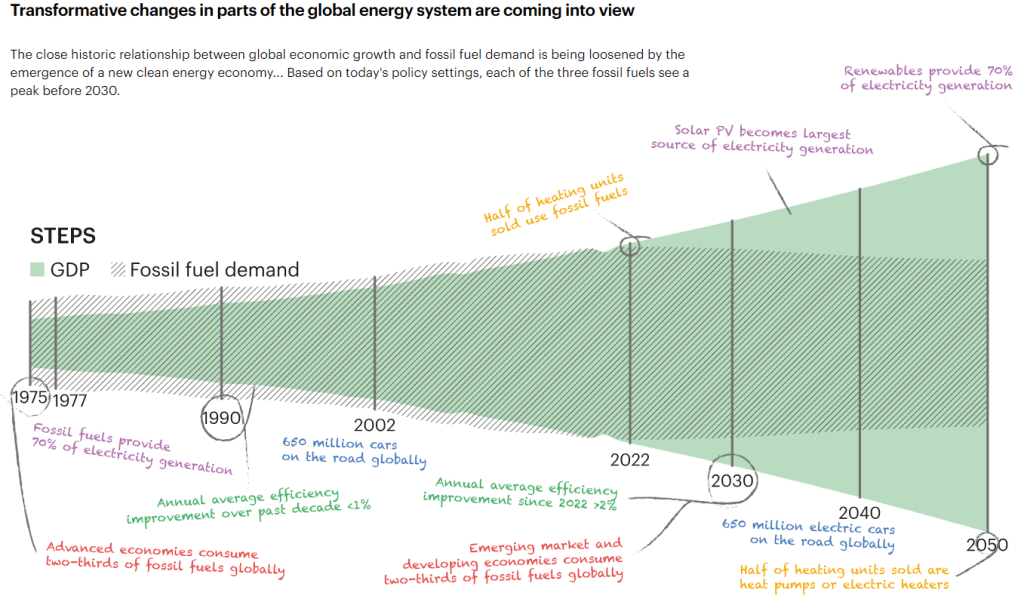

In late September, global energy news was awash with predictions by the International Energy Agency that peak oil was finally in sight and should be expected by 2030. In its most recent World Energy Outlook, the authoritative energy policy agency which advises industrialized nations, forecast by its Stated Policies Scenario (STEPS), that fossil fuel demand remains almost stable around 73% through this decade, caused by the sharp rise in renewables, especially solar PV and wind energy deployment. Global supply of solar has outstripped forecasts, with large industrial scale projects popping up from India to Morrocco to Abu Dhabi. Rystad Energy forecasts solar capacity addition from China, the global solar leader by far, to almost double from 87GW in 2022 to almost 150GW in 2023. And it doesn’t stop.

… projections show that the significant acceleration is not going to slow anytime soon. About 165 GW is expected to be added in 2024 and 170 GW in 2025. This growth will see China’s cumulative solar PV capacity reach over 700 GW by 2024 and increase to close to 900 GW by the end of 2025, before topping 1 TW in 2026.

Rystad 2023

By 2050, the share of fossil fuels spread across oil, gas and coal will make up only 30% of the energy mix, owing to hard-to-decarbonize sectors like steel, cement, and petrochemicals. Today, it is renewables that hold 31% of the energy mix, in a transition profile that will see the renewable-to-fossil percentages flip over the next 25 years.

What does this mean for the fossil economy? The most important question for all current new investments is the price of stranded assets when fossil fuel demand shrinks in the total mix. Even though this may serve as a warning for fossil fuel investors, shareholders and policymakers who fail to adjust in time in line with the global energy transition, a brilliant opportunity exists in the transition pathway to Net-Zero.

Very few industries have as much expertise, knowledge and accumulated experience in a parallel field waiting to be harnessed as the fossil industry has for shifting to renewables. This is very much like the early century proliferation of the smartphone which savvy companies like Apple, Google and Samsung caught on, to the detriment of a prior mobile giant like Nokia. Energy companies today are at the prime moment to leapfrog into the energy of the future. Data from 2022 lists fossil energy companies as holding slightly over 1% of the world’s total installed renewable energy capacity. McKinsey says this is not enough, and with renewables seeing a 6.9% annualized expansion year on year to 2030, fossil fuel companies can leverage their expertise into offshore project development (wind, solar, hydrogen and heat), hydrogen production and transportation (from current gas production capacities), EV charging (from existing retail networks) and decarbonization solutions (carbon capture, utilization and storage, renewables generation and technical expertise for batteries production).

No matter how fossil fuel companies imagine the future, renewables are here to stay. Companies like Equinor and TotalEnergies, have already started to buy into that reality, changing their names from Statoil and Total respectively to reflect their new focuses. Global political and technical response must work hand in hand towards the goal of managing the energy transition in a way that brings on board the full expertise of the current energy industry and reduces the odds of leaving anyone behind.